Life insurance guide

Life insurance provides a non-taxable amount of financial coverage that will be payable to your loved ones if you die. This amount, which you choose when purchasing the insurance, will be given to your beneficiaries, who are the heirs of your insurance. You could choose your life partner, your children or even your parents.

Here's how your loved ones could benefit from your insurance coverage amount :

The Typical Cost of Life Insurance

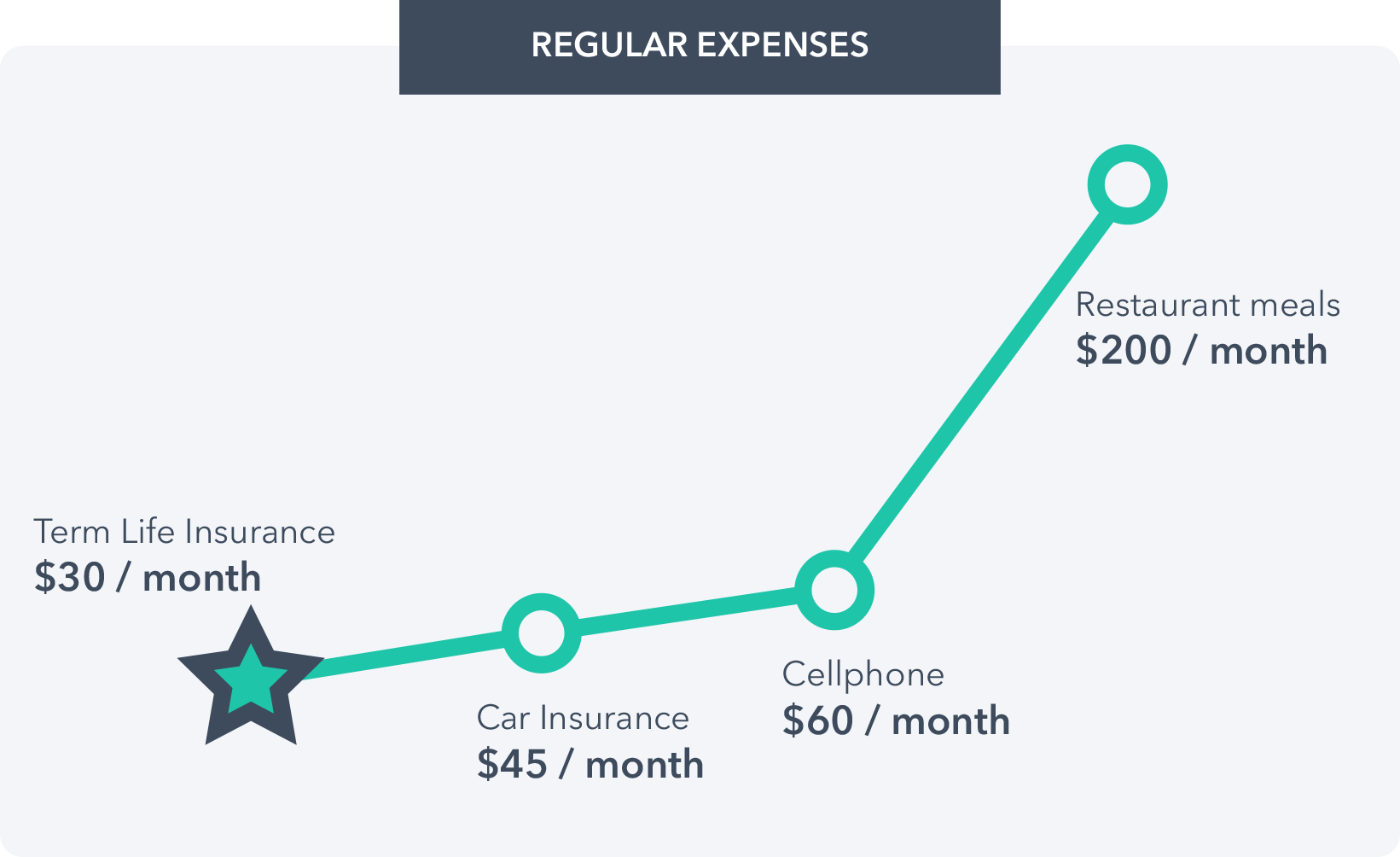

Many people overestimate life insurance costs. You may be surprised to learn that a term life insurance might cost you as little as $ 25 to $ 35 per month. Compared to other costly living expenses, it’s clear to see that life insurance won’t burn a big hole your budget!

Sources : Statistics Canada, CRTC and GAA

What are life insurance policy prices based on?

The price of life insurance policies is based on a few basic criteria, such as your gender, age, consumption of tobacco and non-prescribed drugs, as well as your health condition and lifestyle in relation to the type of insurance and duration of the plan you’re applying on.

Gender

Men and women have different life expectancies. Life insurance is therefore cheaper for women than it is for men.

Age

Statistics reveal that the younger a person is, the less likely they are to die. As such, life insurance is cheaper for younger people.

Amount of Insurance

Insurance pricing is based on a simple rate per thousand (cost per $1000). Higher coverage amounts give you access to volume discounts.

Tobacco / Marijuana Consumption

According to Statistics Canada, the use of tobacco and marijuana accounts for hundreds of thousands of deaths every year. That's why insurance costs for smokers may be double that of the cost of non-smokers or ex-smokers.

Health Condition and Lifestyle

Based on your health, family history, and lifestyle, the price of your insurance may vary. For example, if your favourite sport is parachute jumping, your insurance may be more expensive than that of a person whose sport of choice is walking.

Insurance Coverage Duration

A longer duration (term) results in a higher price. However, a long duration lets you avoid price increases if you wish to renew your coverage over time.

What different types of life insurance are available?

There are two main life insurance categories : temporary and permanent. Permanent insurance can be either universal or universal.

Term (temporary) insurance

temporary insurance needs, such as mortgage payments or the financial support of dependents

Whole life permanent insurance

permanent insurance needs, such as funeral expense payments, death tax, or leaving an inheritance to loved ones

Universal permanent insurance

maxed out RRSPs and TFSAs looking to invest more on a tax-free basis

Term (temporary) life insurance

Term life insurance is an affordable and sensible choice for parents with young children.

Term life insurance provides insurance coverage over a period that you choose. If you die during this period, your beneficiaries will receive the chosen amount.

Advantages

- It’s the least expensive insurance option.

- It’s easy to understand.

- You can choose a duration period that suits your needs, such as taking insurance out while you cover your mortgage payments, or until your children enter the workforce.

- Flexibility: you can adjust your policy according to your future needs, you can renew it, reduce the coverage amount, cancel the policy, or even convert it to permanent insurance.

Disadvantages

- If you don’t die over the course of your insurance coverage period, your loved ones won’t benefit from the insurance coverage amount.

- At the end of the term, if you decide to renew your insurance, premiums will increase due to your age, which is the main criteria used by insurance companies when determining policy costs.

Permanent life insurance

Permanent life insurance is a good choice if you want a policy that covers you throughout your entire life, and if estate planning is one of your primary concerns.

There are two types of permanent insurance: full life insurance and universal life insurance. The first provides full insurance for your entire life, while the second doubles as a tax-free investment tool. You can also use a portion of the insurance during your lifetime by using the surrender value of your insurance, which is an amount that increases over the years, that will be given to you if you decide to abandon or reduce it.

Advantages

- Covers you throughout your entire life.

- Allows you to receive a cash value if you no longer need insurance.

- Allows you to earn tax-free savings.

- Economical in the long-term: If you want to be covered for your entire life, it may be better to purchase permanent life insurance rather than continuously renewing temporary life insurance, which may be more costly in the long run.

Disadvantages

- This type of insurance is much more expensive than temporary insurance. For example, a $75,000 permanent life insurance policy may cost the same as a $500,000 policy.

- This insurance is more complex.

What type of insurance should I buy?

Before making a choice, it’s essential to set clear goals for yourself and to understand what your actual needs are.

Temporary insurance protects you in the event that you don’t foresee having any financial obligations to account for you and your loved ones in the future. When it comes to mortgage payments, and paying off other significant debts, temporary insurance is ideal. This insurance amount is also used to replace your income and support your loved ones for many years, should you pass away during the coverage period. This insurance policy is especially beneficial when your family and children rely on your salary to maintain their living standards and pay for basic living expenses.

Permanent insurance protects you from lifetime costs, such as inheritances, funeral expenses, or taxes on capital gains at the time of death. This type of insurance may sometimes increase in value over time. As an investment, it’s possible to withdraw the money later or receive a dividend from the insurer.

In many cases, temporary insurance is not only the simplest but the most appropriate choice. It helps cover greater financial needs affordably. For others, a combination of both types is most suitable.