Compare life insurance quotes and get the coverage that's right for you

Compare quotesCompare quotes from Canada's best insurance companies

Simple. Online. Transparent.

Here's how we simplify life insurance

What makes Karma so good

Caring certified financial security advisors are always available and ready to help. They’ll listen to your needs and provide you with honest and transparent advice so that you get the coverage you need. Plus, you can easily browse and compare quotes online anytime, anywhere, and on your own terms.

“Insurance experts when you need them, technology for everything else!”

Find coverage that's right for you

Not sure about how much coverage you and your family need? Don’t worry. Our online calculator helps you assess your needs, quickly and easily.

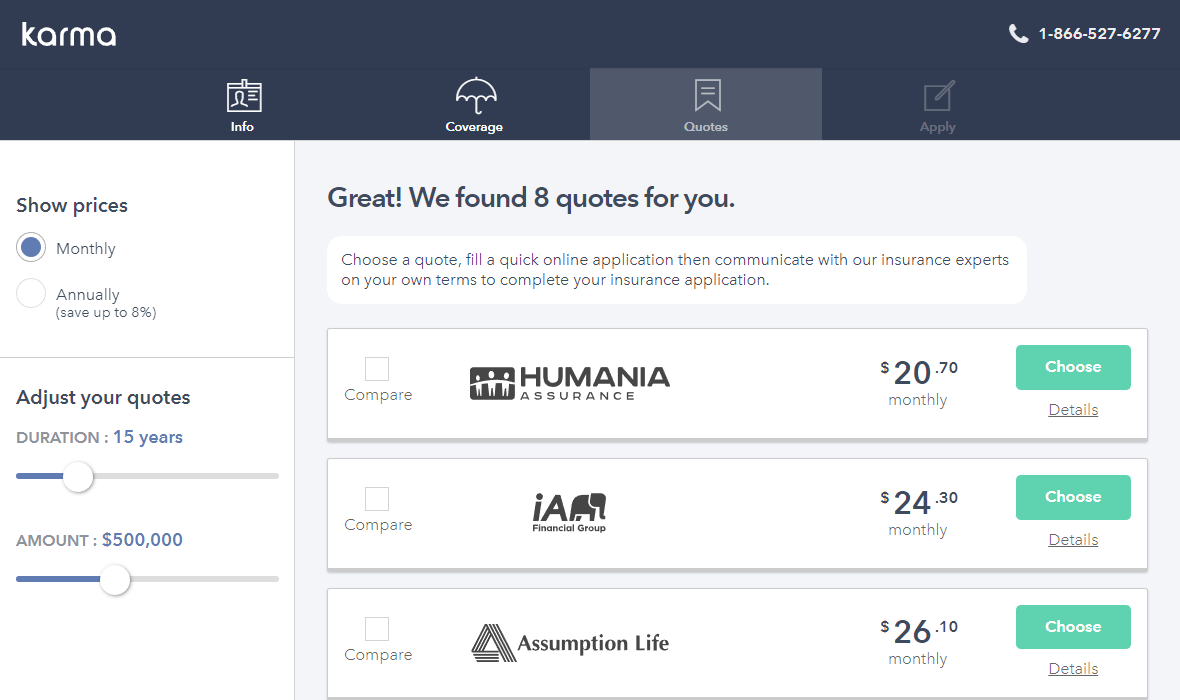

Compare quotes and save money

Based on your needs and priorities, our optimised comparison tool will propose quotes from Canada’s leading insurance companies.

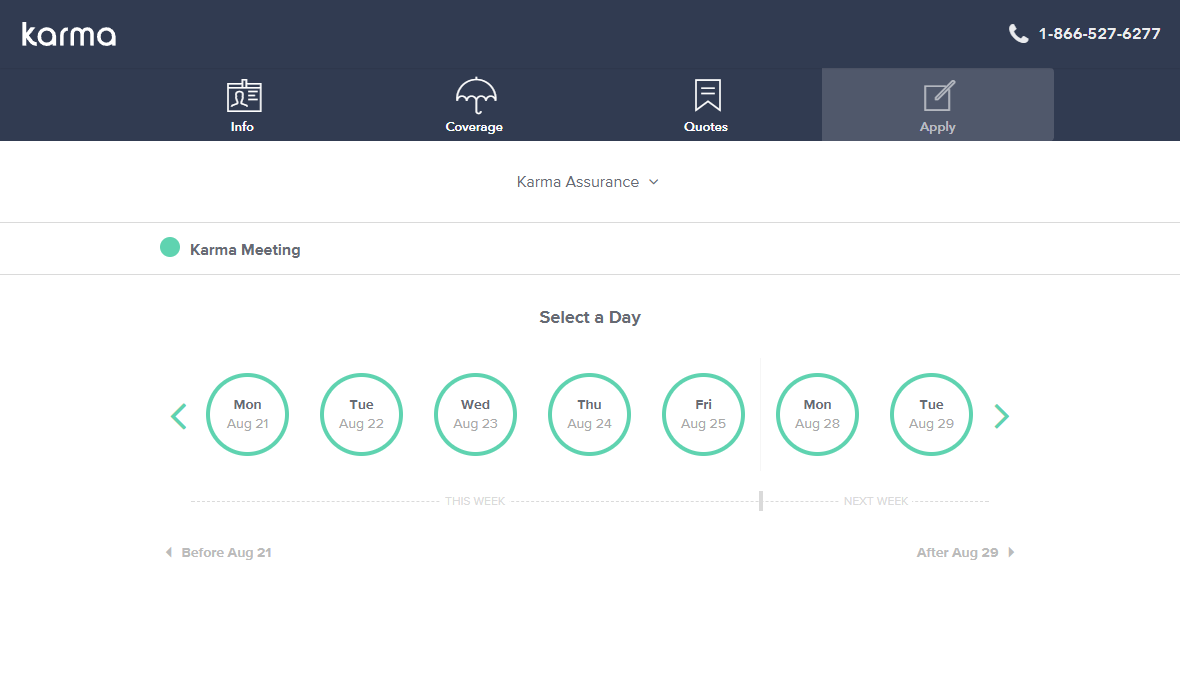

Apply online and finalise

Apply online and your dedicated insurance advisor will check in to make sure you’re getting what you actually need. All it takes is one phone call and you’ll be sealing the deal in no time!

Understand life insurance

Life insurance supports your life goals : become a homeowner, raise a family, provide tuition for children, prepare your retirement, protect your loved ones in case of premature death, etc. Perfect to cover financial liabilities (debt, mortgage) or to maintain your family's lifestyle, it is paid tax-free to your beneficiary.

There are two types of life insurance policies to best meet your needs : a term protection (temporary) or a permanent protection, meaning for your whole life.

Term life insurance

This insurance protects your family if you die prematurely. In that case, your beneficiary receives a sum of money to help face financial difficulties such as :

- Paying for your funerals ;

- Paying off a mortgage and your debts ;

- Providing financial support to your family .

How long are you insured for?

The coverage term is determined at the start, for a fixed duration (10 or 20 years, T10 or T20), or until a certain age such as 65 years old.

What happens at the end of the term

The protection ends. No money is paid to your beneficiary if you are still alive. Your premium payments are not refunded either. This type of insurance covers a temporary risk, similar to insurance while you own a house or a car. Many term life insurance policies are renewable, meaning they will renew for the same duration.

How are your premiums calculated?

The price of your insurance is mainly calculated using your age, the state of your health and the amount of coverage to be paid out in case of death. If you are young and non-smoker, you will pay less! Indeed, you are much less at risk than a smoker in their sixties.

Can the price of your insurance policy increase?

The amount of premium payments remains fixed for the whole term. If you opt for a renewable policy with a 10 year term for example, the premiums will increase only at the time of renewal.

How can you know it's the right insurance type?

This contract covers a temporary insurance need, such as mortgage, debts and dependents. Moreover, you may tailor it according to your needs over time. Contact one of our advisors. They will evaluate your life goals with you and suggest the most appropriate coverage.

Whole life permanent insurance

As the name indicates, this insurance policy protects you during your entire life, whenever the inevitable happens. Your beneficiaries will receive benefits so long as your insurance premiums were paid for. There is no predetermined term.

You may plan to pay off your funeral fees, your estate and income tax and leave an inheritance for your loved ones.

Will the premiums increase over time?

No, your premiums and your benefits are guaranteed for life.

How do cash value and withdrawals works?

By owning a whole life insurance, it becomes possible at any time to withdraw funds, partially or totally. In any case, you cannot unlock a sum superior to the cash value of your policy, which increases over time. It's also possible to borrow against the value of your contract, which is like a loan from the insurer, leaving the life insurance contract intact. Such loans are similar to withdrawing from your policy : the insurer cannot lend a sump superior to the cash value of the contract.

Universal life permanent insurance

Your RRSP, TFSA and other registered accounts are maxed out and you wish to maximize your legacy? This contract is for you! It lets your money compound tax-free in an investment of your choice, as long as you don't withdraw it. It consists of a life insurance policy tied to an investment. Universal life permanent insurance is an efficient estate planning product, because it can yield a very good internal rate of return while growing tax-free.

Universal life insurance contains an investment account to achieve that.

You therefore have access to a cash value whenever you need it. That value can increase according to the investments you have chosen.

Can you choose your death benefits?

Yes, the death benefits are proportional to your premiums. You may choose according to your payment capacity.

Is it possible to make extra contributions?

Absolutely, you can contribute extra payments, on top of your regular premiums, to benefit from the fiscal advantages of life insurance. You therefore have the possibility of boosting your savings while increasing the legacy your beneficiaries will inherit, tax-free.

Our financial security advisors are available to discuss the details with you.

Frequently asked questions

Yes, our service is absolutely free and won’t increase your insurance plan costs. We only get paid by insurers if you find the right coverage for your needs. That’s why we work hard to ensure that your end-to-end experience is streamlined and enjoyable.

We provide full transparency so you can understand your insurance needs, compare prices and product details online before speaking to an advisor.

Temporary life insurance is affordable and valid for a duration of your choice. On the other hand, permanent life insurance is more expensive, but is valid for a lifetime and cumulates a cash value, which can be accessed later on. Read our life insurance guide to learn more.

Your dedicated advisor will take care of every step in the application process until your coverage is active. Beyond that, they remain available to answer any questions or assist with any further needs.

If you call an insurer they’ll quote you with the same price and suggest you contact an agency to purchase your coverage. Karma can help you save by comparing the best prices among 19 insurers, including paper-based products not yet on our online platform. If you have a particular health or lifestyle situation, we can shop according to your situation and find the most competitive pricing.

Anyone with financial obligations or loved ones that depend on them.